Features of Complete Share Market Technical Analysis Course in Delhi:

- No More Boring and Lengthy Lectures and Study Material

- Training in Live Market Hours

- Will take positions and initiating trades in our own live accounts and show you how much profit that we are booking from Indian stock market.

- Earn up to 10% profit monthly

- Course is designed specifically for Investors who would like to get huge returns from the market

- Learn the advanced and hidden techniques that will minimize your risk levels and maximize your profits.

- If you do have capital, we will teach you how make it double every year.

- Get daily stock tips from Nasir Mirza on WhatsApp after the course for free lifetime

- Learn from the trader , not from trainer

- Students can start generating profit from the first month after joining the course.

- Low strength of Batches

- Doubt Clearing Sessions

- Learn only the advanced and money-making strategies

- Be Your Own Boss and start making money by sitting at the comfort of your home

- Just Compare our syllabus and chapters with any other institute and decide yourself. We guarantee that nobody will cover up the number of modules as we are covering.

Detailed Syllabus of Stock Market Courses Delhi:

1. Advance Technical Analysis Module |

Introduction to Technical Analysis

History Behind Technical Analysis

Types of Charts

Implementing Chart and Candlestick Patterns

Trend analysis

Oscillators

Moving averages

Technical theories

|

SENTIMENTAL INDICATORS

Ratio Analysis

Chart formations Trend reversal formations

Trend continuation formation

Specialty indicators

STOP LOSS

Volume and open interest

Intermarket Technical Analysis

Technical analysis indicators

|

2. Advance Option Analysis Course Module |

Chapters Including Options Analysis

Strategies to Be Covered in Option Trading:

|

APPLICATIONS OF OPTIONS CALCULATOR LIKE BLACK SCHOLES, PROBABILITY CALCULATOR ETC.

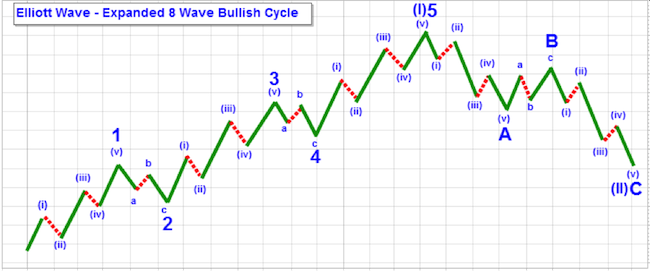

During the course we will focus on wave pattern and recognition and also show you how to imply the rules of wave theory accordingly and in a well chronological order. It’s a dominant theory in modern finance. The course is suitable for the traders which are having technical knowledge of the financial markets. Course is design in such a manner that is suitable for advance learners and basic learners.

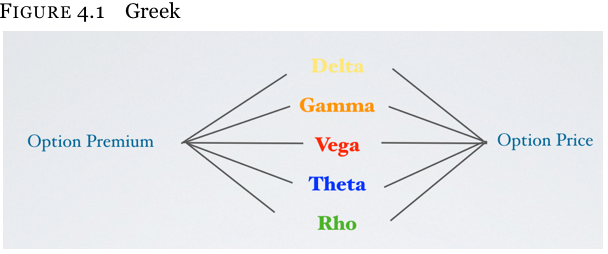

3. Advance Option Greek Course |

| Learn to drive the market jumps and fizzle out. Whether the market is up, down or sideways, you can use options trading to come out ahead. The Advanced Options course will focus even more Strategies to use and to manage risk and help you reach your financial appetite. You’ll learn several conservative strategies that can be applied in different ways – This course will take your option trading skills to a higher level, step by step. |

4. Elliot Wave Course Module |

- Chapter 1: Introduction

- Chapter 2: Market Prediction Based On Waves

- Chapter 3: Elliot Waves Personality and Characteristics: dominant Pattern and Corrective Pattern

- Chapter 4: Elliot Waves Rules and Guidelines

- Chapter 5: Pattern Recognition and Fractals

- Chapter 6: Fibonacci Relationship

- Chapter 7: Example of the Elliot Wave Principle and the Fibonacci Relationship

- Chapter 8: After Elliot

- Chapter 9: Theory Interpretation

- Chapter 10: Series of Wave Categories

- Chapter 11: Conclusion

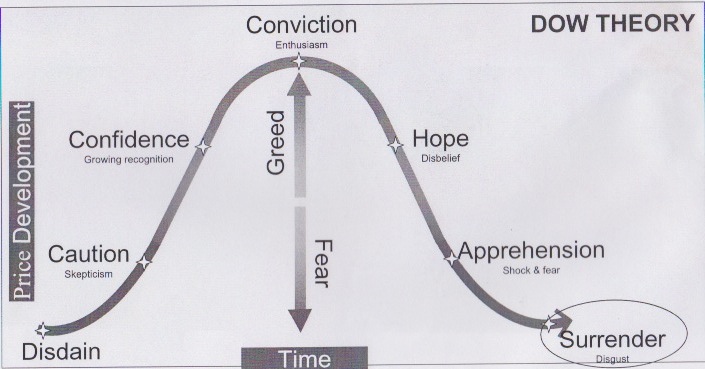

- Chapter 12: Live Applications Of Elliot Wave theory reflects the overall scenario of the market trend. Many of the technical analyst states that follow the ultimate trend of the market rather than focussing on secondary or tertiary trend and avoid following the ripples. Bad news makes the markets shaky and ripples formed so one need to ignore and follow the primary trend. This course focuses on how market reacts on news and ultimately follows the primary trend. During the course you will learn how to implement dows applications on real market graphs.

5. Dow Theory Course Module |

- Chapter 1: The Market Discounts Everything

- Chapter 2: The Three Trend Market

- Chapter 3: Primary Trend Has Three Phases

- Chapter 4: Market Indexes Must Confirm Each Other

- Chapter 5: Volume Must Confirm the Trend

- Chapter 6: Trend Remains Intact Until Or Unless Clear Reversals Occur

- Chapter 7: Specifics And Significance Of Dow Theory

- Chapter 8: Problems With Dow Theory

- Chapter 9: Current Relevance

- Chapter 10: Fibonacci Channels

- Chapter 11: Conclusion

- Chapter 12: live Applications of Dow Theory Derivative market is the most pre-dominant part of the financial world. This course not only gives you an insight into the most complicated world of derivatives market but also reflects the hidden part of FNO segment. If you want to be a portfolio manager, trader, derivative analyst, Investor, arbitrageur etc than this is the course to begin with. The course has been designed in the simplest manner and also focuses on real time markets explanation so that one can co-relate the accuracy and the logic behind the strategy.

6. Derivative and Option Analysis Course Module |

- Introduction to derivatives

- Understanding interest rates and stock indices

- Futures Contracts: Mechanism and Pricing

- Application of futures contracts

- Options Contracts: Mechanism and Application

- Pricing of Options Contracts and Greek letters

- Settlement of FNO

- Marging system

- Intro to Derivative Analysis

- Open Interest and Price relation

- Most Active Contracts

- Most Active: Calls and Puts

- PCR Put Call Ratio

- Highest in Premium

- Practical Exposure and Live Projects

- Intro to Derivative Analysis

- Open Interest and Price relation

- Most Active Contracts

- Most Active: Calls and Puts

- PCR Put Call Ratio

- Highest in Premium

- Practical Exposure and Live Projects

- Put call ratio

- What are options? Types of Options ITM,OTM,ATM

- Long Call/short Call/long Put/short Put

- Synthetic Long Call [married Put]

- Covered Call & Put

- Long Combo

- Protective Call

- Long & Short Strangle

- Bull Call & Put Spread Strategy

- Bear Call & Put Spread Strategy

- Long & Short Call Butterfly

- Long & Short Call Condor

- Covered Combination Construction

- Stock Repair Strategy

Total Fee of the Course: 30,000/- Only Including Taxes

Duration of the Course: 3 Months

Call Us now @ 9999959129 for stock market courses