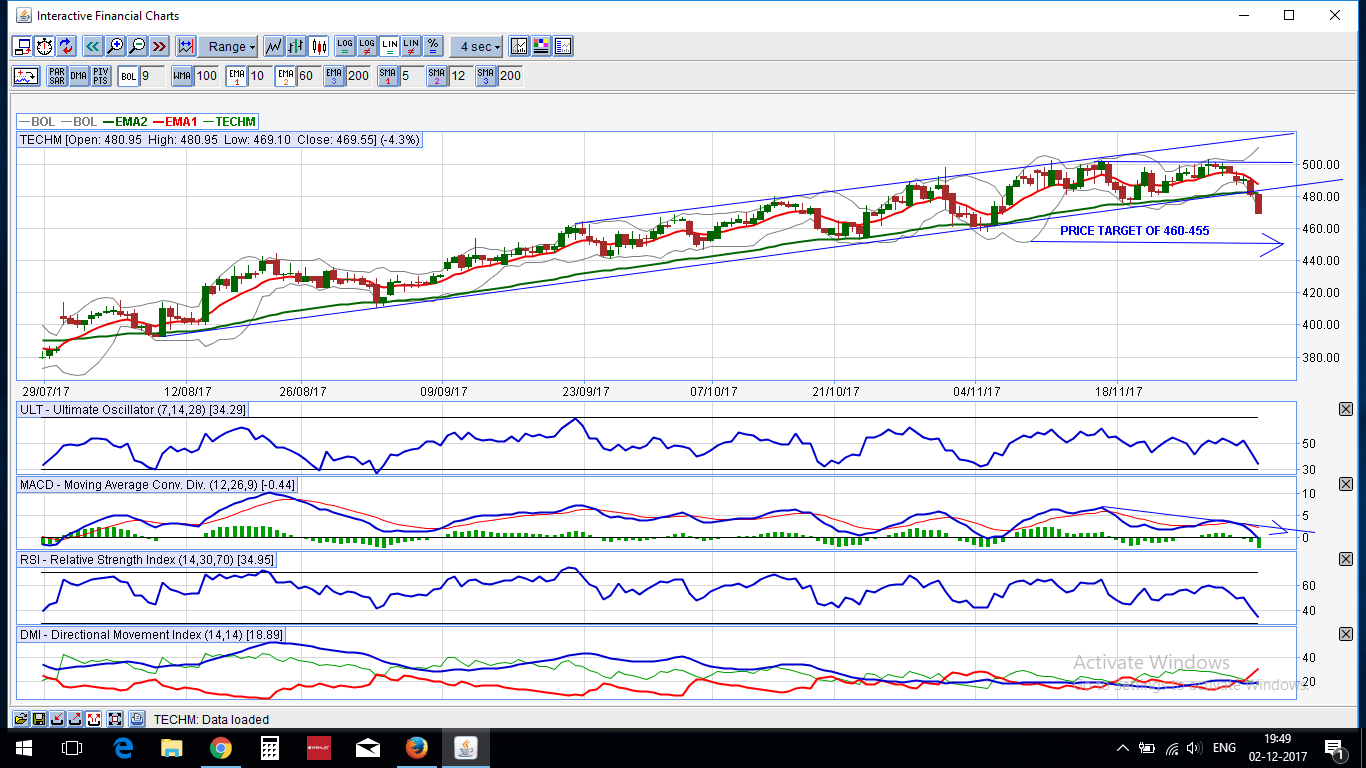

Rising Wedge breakout in Tech Mahindra. Selling opportunity for bears.

A rising wedge is bearish in nature as the prices always forming higher tops and higher bottoms within a particular wedge shape or in between two support and resistance trend lines.

There are two types of wedge shapes as a parallel wedge and a rising wedge when the two trend lines converge each other as the price pattern matures.

Here in TECH MAHINDRA, the stock price has formed a parallel wedge which has broken below its support trend line with volumes rising and a bearish marubozu candle confirms the breakout.

Moreover , a 60 day EMA , which was actually providing a well good support to the channel also breaks below that level.

Indicators like MACD, RSI and other momentum indicators also confirms the trend reversal for the short term horizon when they start showing the divergence in prices.

After looking at the open positions in the futures derivative market, the continuous build up of the new positions in the open interest also an indication of the bearish activity as the new positions building up in the direction of prices.

Here is the snapshot: