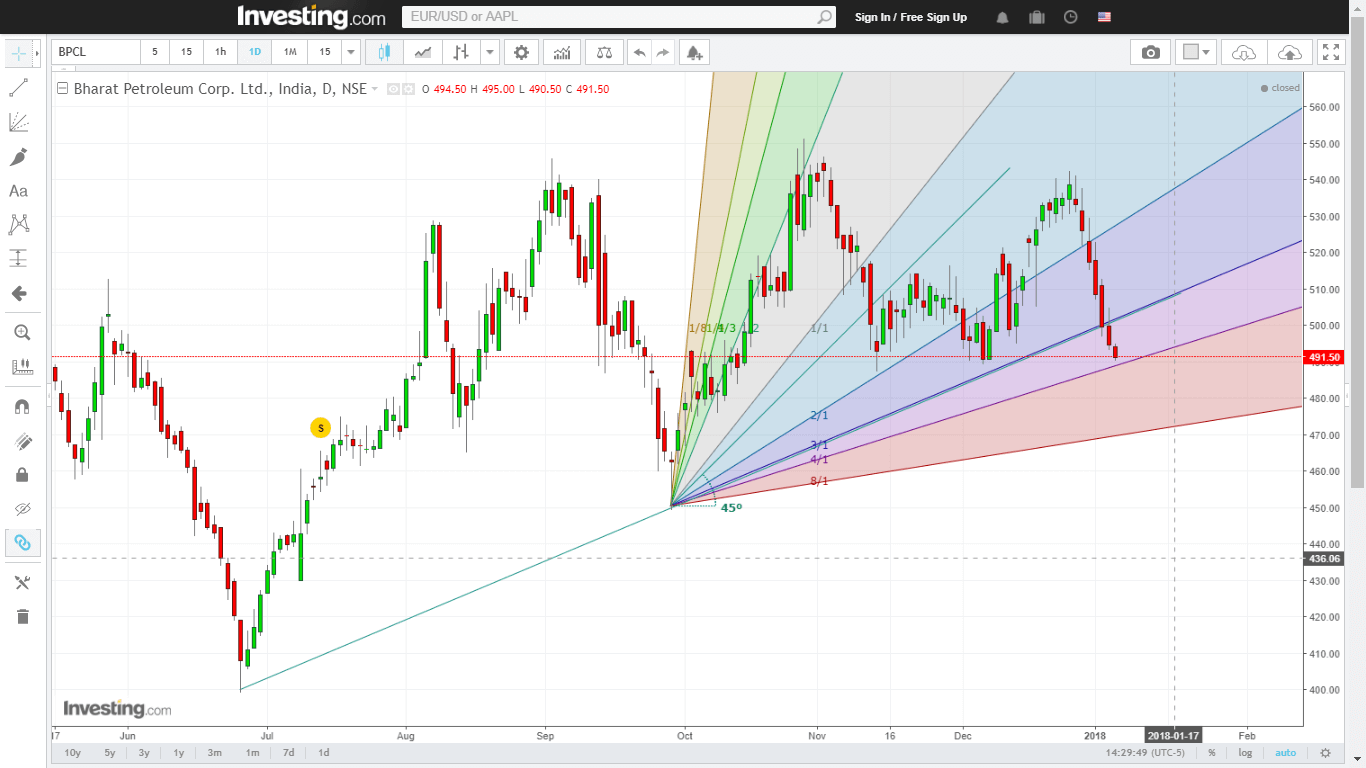

BPCL showing a selling opportunity as the prices confirming a downside. Technical factors confirming the downside are as follows:

- Break down of a trend line on weekly charts.

- Candle stick analysis pattern on weekly charts indicating a sell signal as the prices are closing below previous weeks closing of 515. Length of the stick also increase as the trend continues.

- Rounding top formation on hourly charts also confirming that we are near to breakout of the pattern.

- Open interest increase for the last three sessions also providing the confirmation of short build up as the pattern unfolds.

- Put Call Ratio analysis favoring bears as it stands at 0.45 which is below 0.70 indicating sell on rise.

- Highest open interest build up at 520 acts as strong resistance.

- 60 EMA on weekly charts showing support at 465 also looking like an automatic price support.

- here is the snap shot: